Learn how to buy a fax number for submitting your EIN application (SS-4 Form) to the IRS. This guide covers step-by-step instructions for EIN registration and the necessary faxing process.

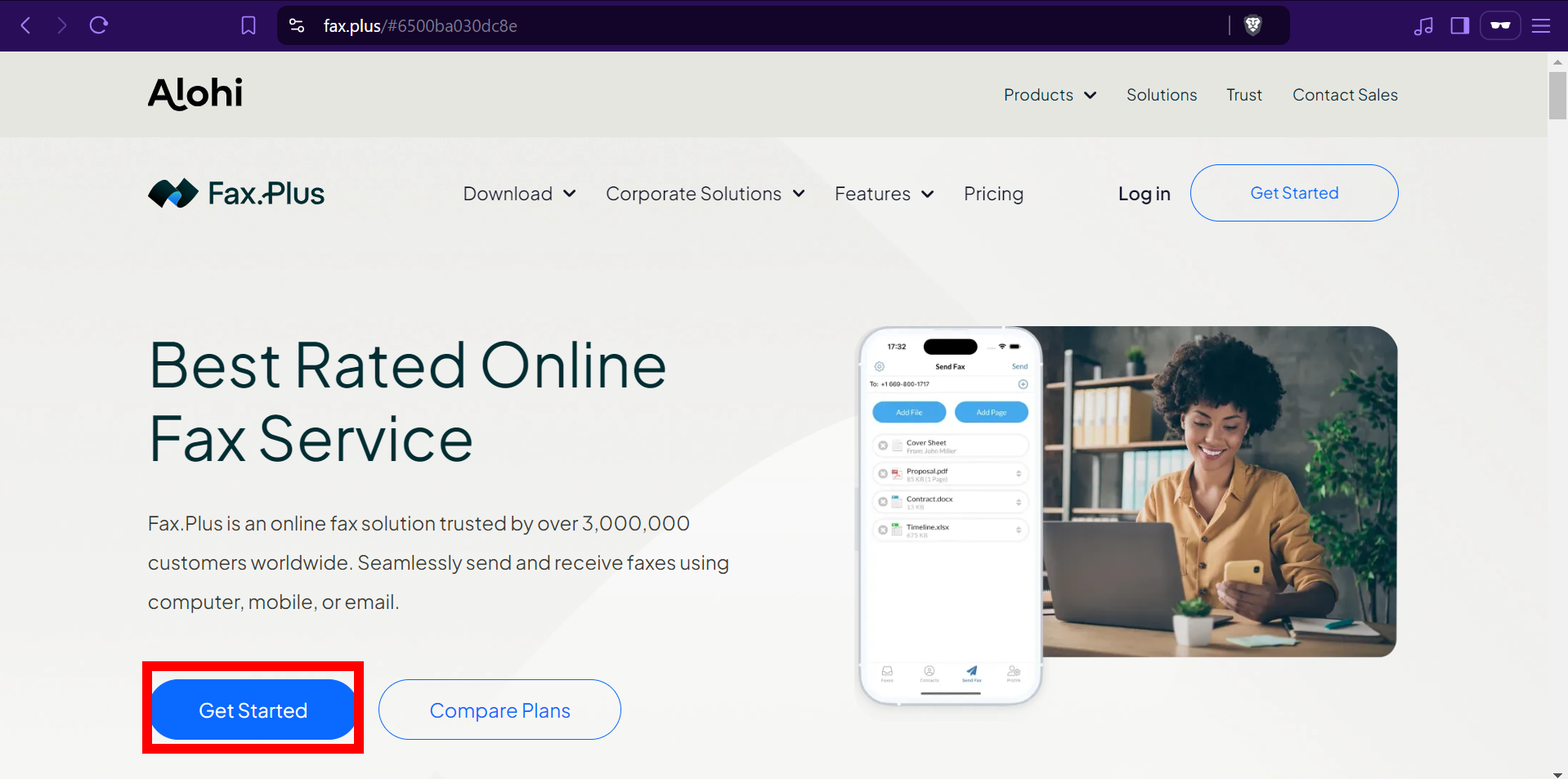

Step-1

At first visit here : https://www.fax.plus/#6500ba030dc8e

And click to Get Started.

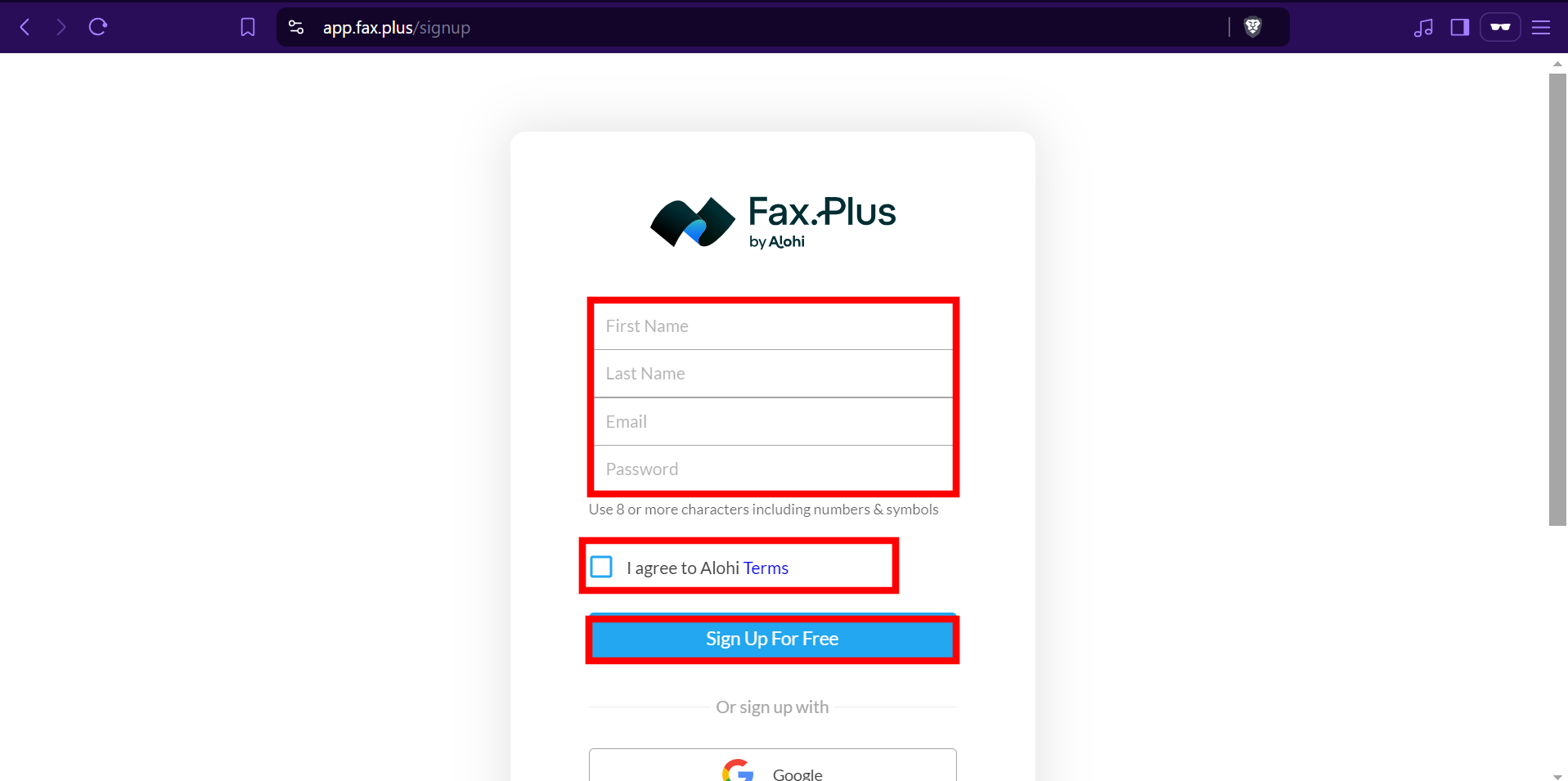

Step-2

Then type your First Name, Last Name, Email and Password here. Also Tick the I agree to Alohi Terms box. And click to Sign Up For Free.

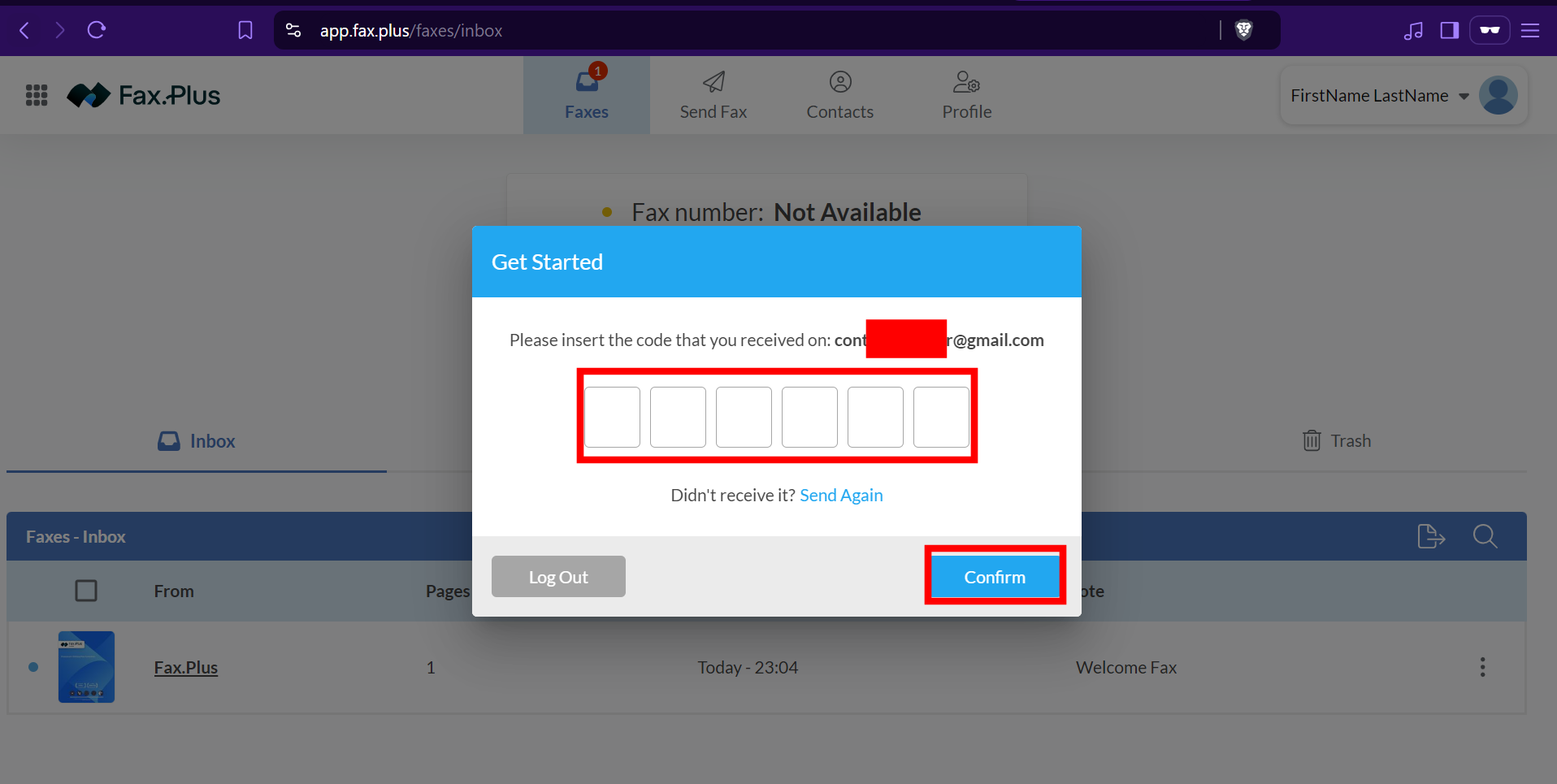

Step-3

Now you need to type the Verification Code from your Email and click to Confirm.

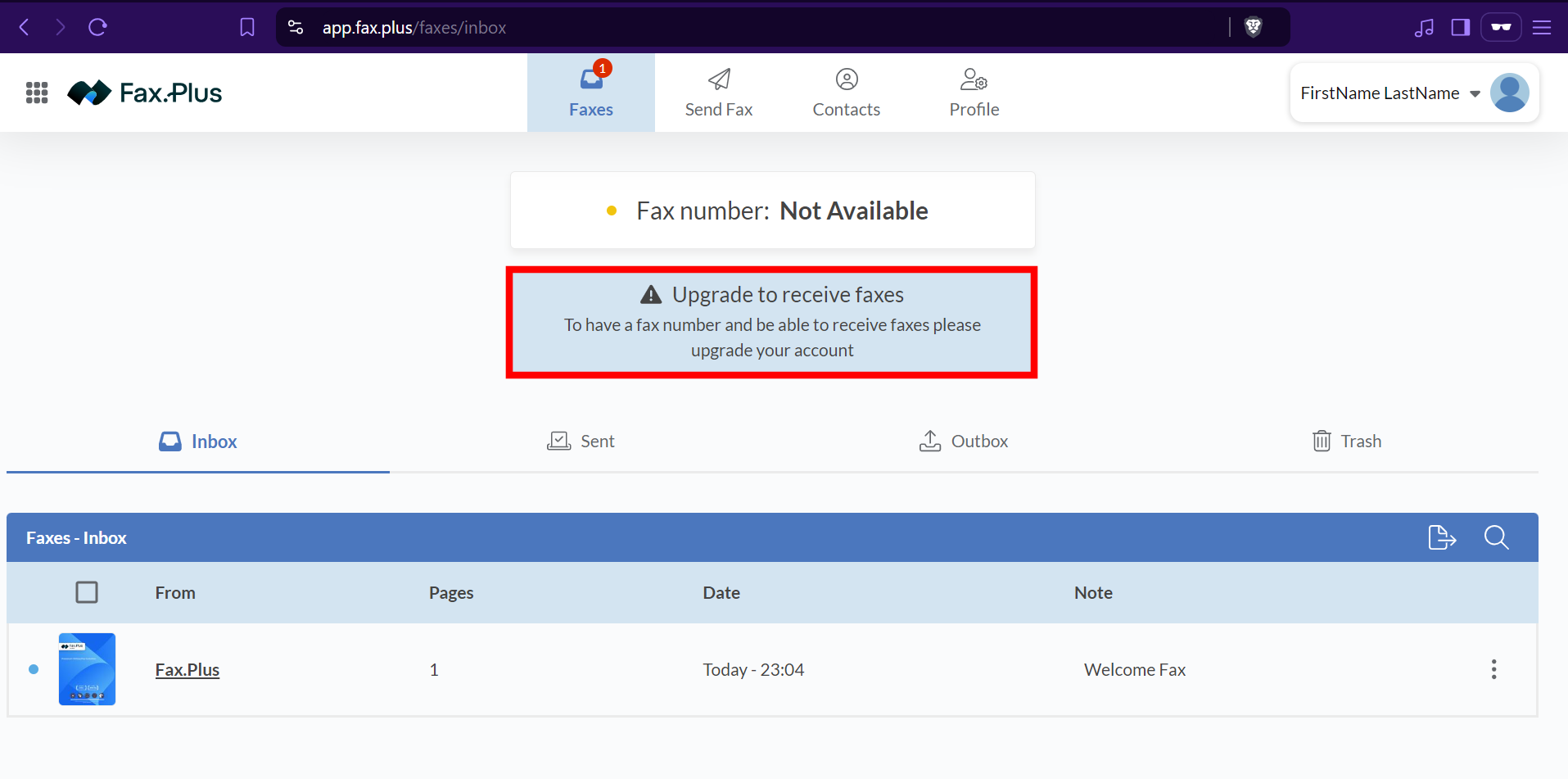

Step-4

In this page, click to Upgrade To Receive Faxes.

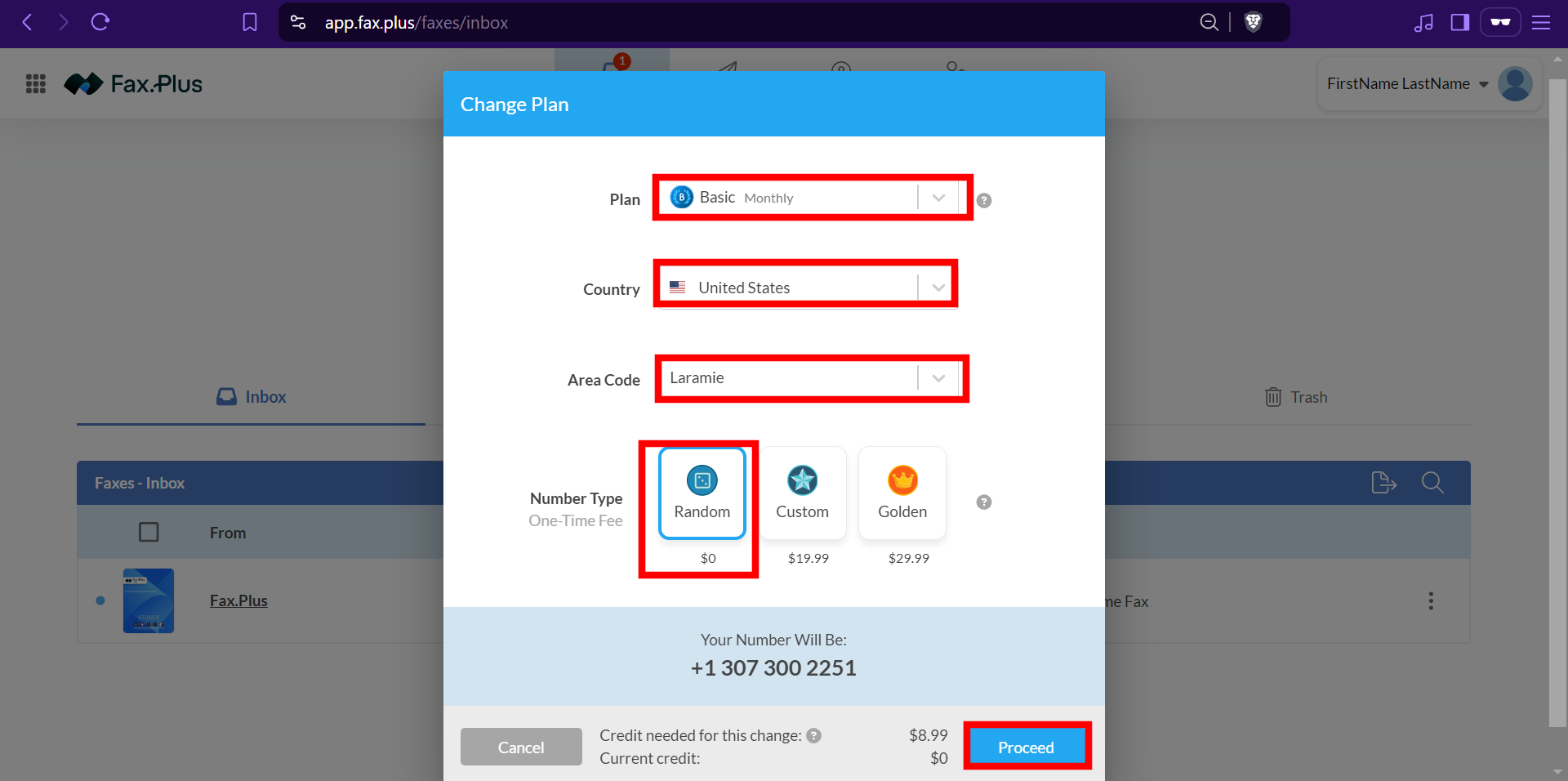

Step-5

Then select –

Basic Plan (Monthly),

Country – United States,

Area Code – 307 (Laramie),

Random Fax Number.

And click to Proceed.

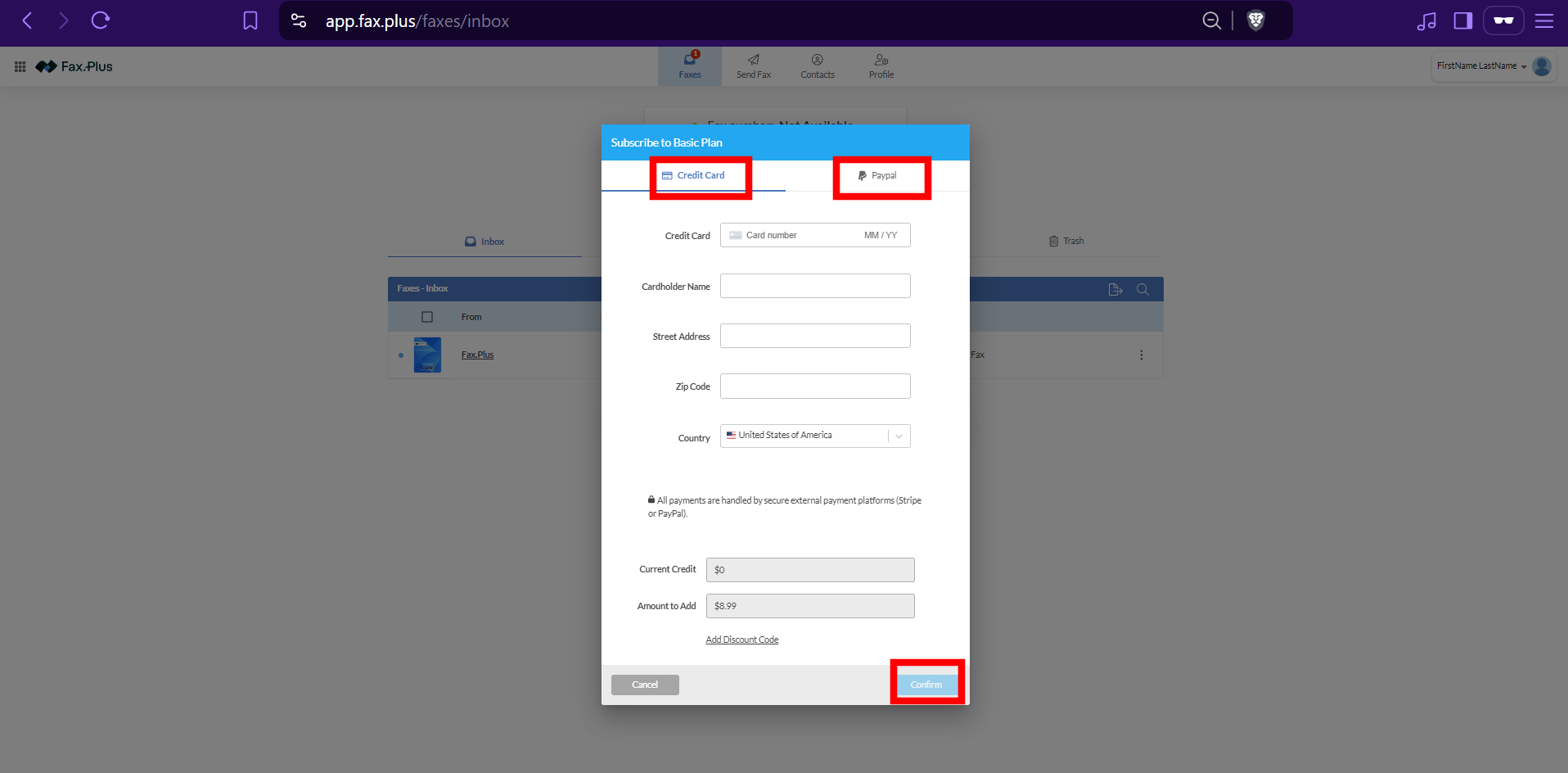

Step-6

Now put your payment details here (PayPal/Credit or Debit Card) and click to Confirm.

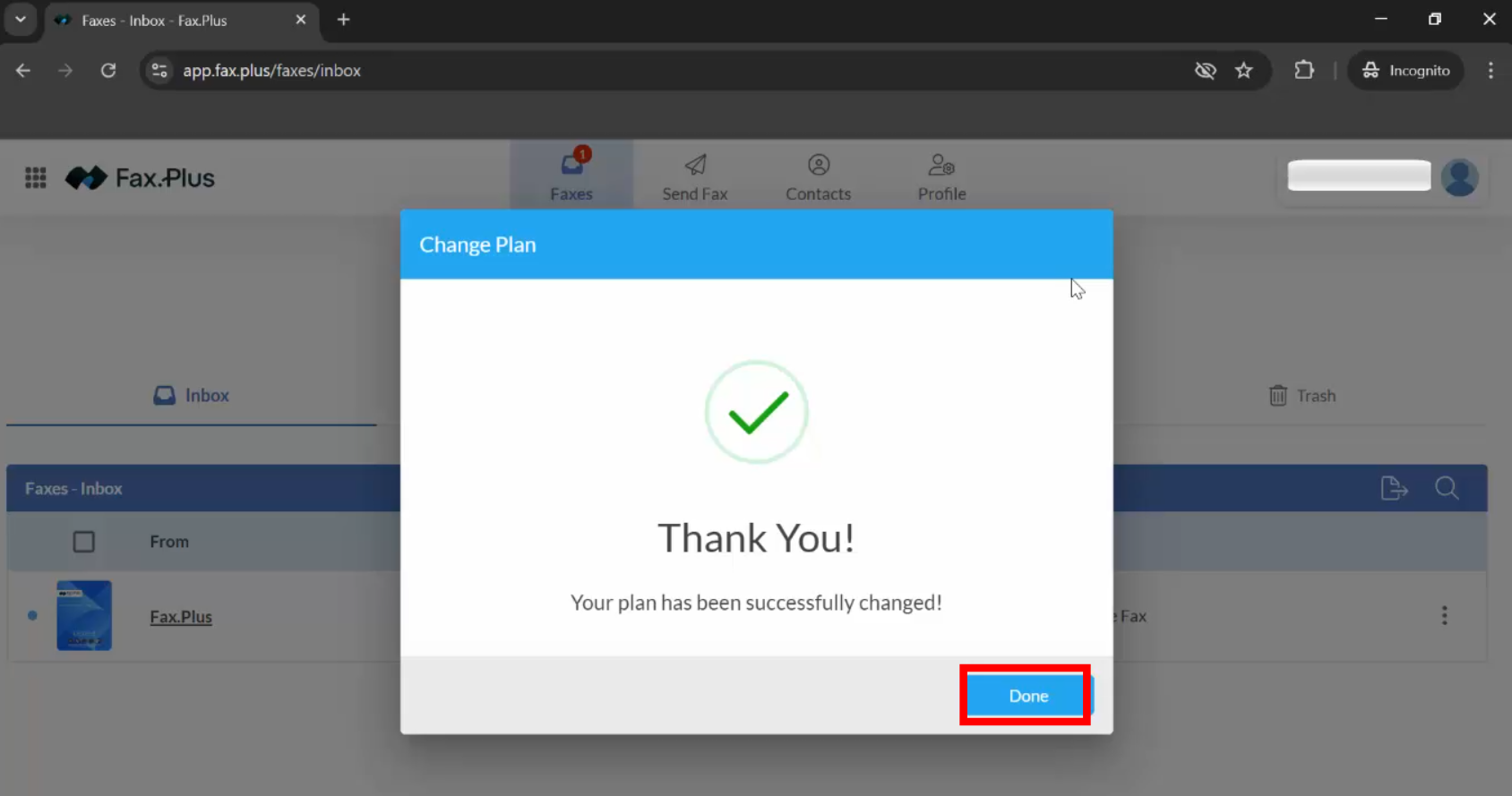

Step-7

Once your payment has been made successfully, just click to Done.

Step-8

Now it’s Done. You’re now able to receive and send faxes.

Now you can send your EIN application (SS-4 Form) to the IRS just click to “Send Fax” button.

To fax your completed Form SS-4 to the IRS, follow these steps:

- Ensure the form is fully completed with all required information to avoid processing delays.

- Fax the form to the appropriate number:

- Within the United States: Fax to (855) 641-6935.

- Outside the United States: Fax to (859) 669-5987.

- Include your return fax number on the form to receive your EIN response within approximately four business days.

For the most current fax numbers and additional details, refer to the IRS’s official guidelines on Where to File Your Taxes for Form SS-4.